I wouldn’t call it any type of ‘detection’. Unless Sense is working on a way to “train Sense”, “tell Sense what to look for”, which I highly doubt as we are still waiting on progressive device detection. There has not been any major improvements to device detection this decade. I have near zero confidence there will be.

Utilities have been asking what type of equipment is in your house along with basic surveys for the past 20+ years to estimate what is using the most electricity and make energy improvement recommendations based on averages.

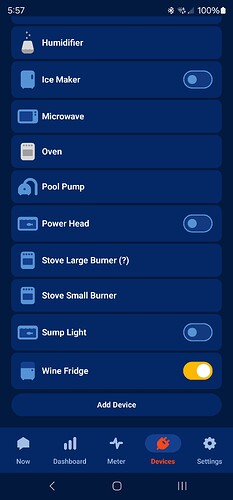

This appears to be nothing more than a colorful way of displaying that. These are not real time devices. They are not post processed devices. They are nothing more than ‘estimates’ based on generic non user specific data of what a given type of device generally consumes. Hence why they have no on/off status, retroactive timeline etc… but could show ‘stats’ based on the ‘averages’ of all users of the device type.

The ‘average consumer’ wants to see something, this is a way of providing that. It’s probably safe to say 98%+ of customers on the utility side will never become ‘invested’ in Sense or even care how Sense works. They care much less about looking at ‘real time’ bubbles all day, all they want is to know why their bills are so damn high. Maybe in a decade or two when utilities start implementing real time ‘demand pricing’ at the device level and ‘demand response’ programs at the device level (in addition to HVAC), but certainly not now. I do believe this is a huge reason why utilities are becoming invested now, as existing smart meters already provide them with customer level grid monitoring, outages, spikes, etc… And a major reason why Schneider and others have taken a different path investing so heavily in smart breaker technology.

Users like us have provided Sense with enough data to make better estimates and when you combine that with native detected data it’s a lot easier sell.

I had really hoped more would come of the ‘home assessment’ report" Sense partnered up with NYS to provide Sense users who opted in a couple years ago. But from what I’ve been told by NYS, Sense has prohibited NYS from doing much with it including providing utilities more accurate estimates.

Now Sense isn’t directly selling users data, but they sure are using it and the ability to collect it as a marketing tool for their partnerships. We all know how Sense over hypes is marketing with some even questioning if it could be consider fraudulent. They is no reason to believe the same thing has not occurred with utilities, investors or anytime else.

I have absolutely no reason to believe Sense is doing anything but the absolute bare minimum to improve it’s product to it’s existing customers. While trying to sell to new utility customers, especially outside the US in order to show a ROI to their financial investors.

IMO Sense needs to really focus on improving real time native device detection, it’s the only real ‘unique’ advantage it has. Unless Sense will be incorporating this as a way to ‘train Sense’ or ‘tell Sense what to look for’, I don’t see them seceding long term as anyone can create generic estimates. I’ve seen no indication that Sense is successfully making any major improvements to native device detection, all signs indicate otherwise.

I hate to say it but pushing utility sales (which they have been extremely successful at) while seemingly investing the minimum to improve the core product is more indicative of a future cash-out.